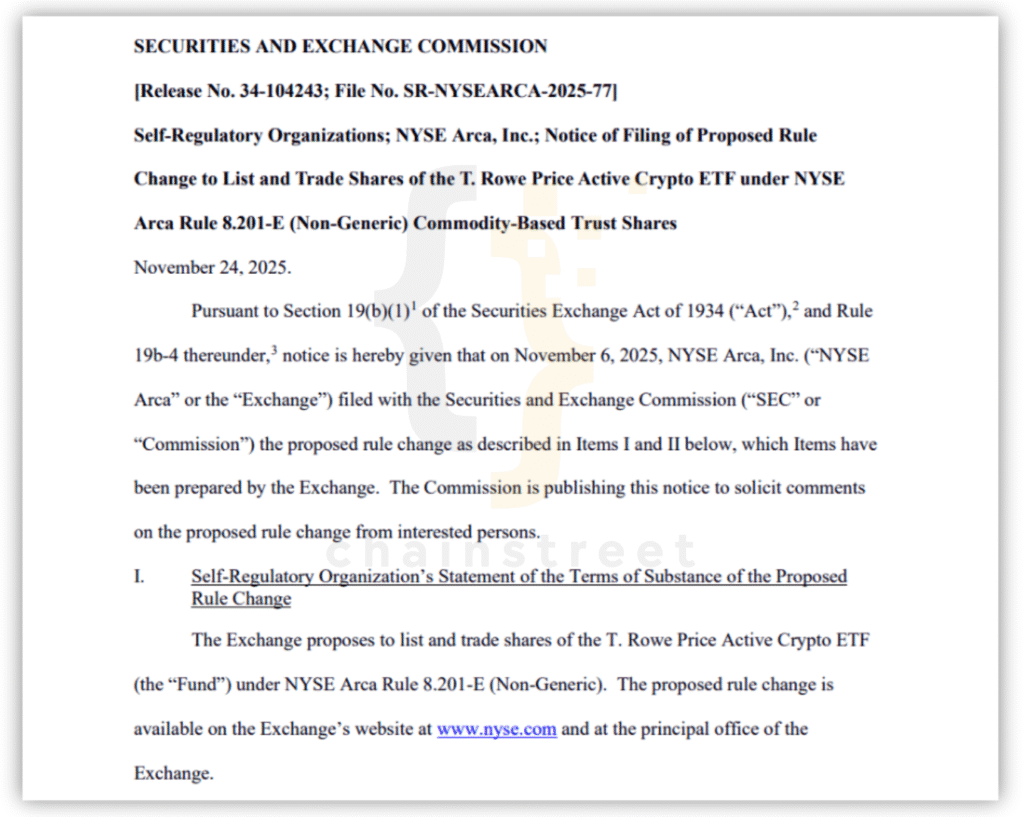

Shiba Inu ETF inclusion has officially moved from rumor to regulatory filing. NYSE Arca submitted a proposed rule change (Form 19b-4) to the U.S. Securities and Exchange Commission (SEC) on November 24, 2025, to list the T. Rowe Price Active Crypto ETF. The document reinforces the issuer’s initial S-1 registration statement, filed on October 22, 2025, which explicitly named Shiba Inu ($SHIB) as a designated “Eligible Asset” for the institutional fund.

Details of the Shiba Inu ETF Inclusion

The filing represents a significant maturation for the asset. While the crypto market has awaited a dedicated spot product, this Shiba Inu ETF inclusion within a diversified, actively managed vehicle offers a faster path to Wall Street portfolios.

According to the “Background on Eligible Assets” section of the 19b-4 (File No. SR-NYSEARCA-2025-77), the Sponsor considers a specific basket of tokens suitable for investment. This list includes market leaders like Bitcoin (BTC) and Solana (SOL), but crucially, it validates Shiba Inu ETF inclusion alongside utility tokens like Chainlink (LINK) and Avalanche (AVAX).

This designation “white-lists” Shiba Inu for T. Rowe Price’s portfolio managers, underlining that the dog-themed meme coin meets the liquidity and custody standards required by a firm with over $1 trillion in assets under management.

Active Management vs. Passive Tracking

The T. Rowe Price fund differs structurally from the passive Bitcoin ETFs currently trading. Passive funds are designed to track a single asset mechanically.

In contrast, this active model empowers managers to make discretionary decisions. By securing Shiba Inu ETF inclusion, the fund allows managers to rotate capital into SHIB during periods of favorable on-chain activity and rebalance into stablecoins during volatility. This structure introduces a layer of institutional risk management to altcoins that has previously been absent in regulated US markets.

Shiba Inu ETF Regulatory Clock

The submission of the 19b-4 triggers the SEC’s official review timeline. Under the Securities Exchange Act of 1934, the Commission typically has 45 days to issue an initial decision on the proposal, with the option to extend the review period up to 240 days total.

If approved, the fund would likely launch in 2026, marking the first time a traditional active management firm offers a regulated product capable of holding SHIB.

Chain Street’s Take

The proposed Shiba Inu ETF moves from speculation to institutional reality. The NYSE Arca filing confirms SHIB as an “Eligible Asset” for T. Rowe Price’s actively managed crypto ETF, putting it alongside Bitcoin and Ether. It is also a Wall Street stamp of legitimacy.

For the first time, professional portfolio managers can legally and compliantly allocate capital to a meme token in a regulated U.S. vehicle, turning what was once fringe into an investable, institutional-grade asset.