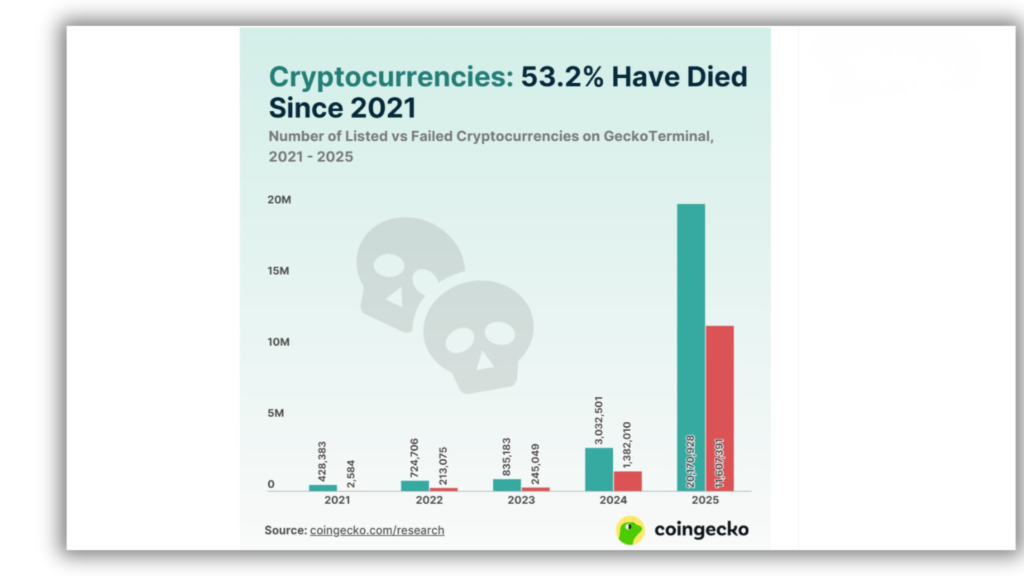

The lifespan of the average crypto collapsed in 2025. Automated issuance platforms flooded the market with disposable assets throughout the year.

A report from data aggregator CoinGecko and GeckoTerminal indicates that 11.6 million cryptocurrencies failed last year. The total represents 86.3% of all project closures recorded between 2021 and 2025.

Market metrics show a structural shift in the digital asset economy. The barrier to entry for creating a token effectively vanished. Ephemeral and speculative assets now saturate the market. Most lack the liquidity or community support to survive beyond their initial launch window.

The Rise of Disposable Crypto

Exponential failure rates stem from the proliferation of automated launchpads. Platforms like pump.fun allow users to deploy tokens in seconds for pennies.

Automated infrastructure drove an explosion in total project counts. GeckoTerminal tracked nearly 20.2 million projects by the end of 2025. This volume dwarfs the 428,383 projects recorded in 2021.

“The ease of launching tokens on launchpads led to a surge in low-effort meme coins and projects entering the market,” CoinGecko stated in the report.

Excess supply overwhelmed available liquidity. Only 2,584 project failures occurred in 2021. The industrialized issuance of 2025 resulted in a mortality rate where more than half of all tokens ever listed on the platform have now failed.

The October Liquidation Catalyst

Systemic volatility acted as the primary executioner for these fragile assets. The fourth quarter of 2025 proved particularly lethal. The period accounted for 7.7 million token collapses, representing roughly 35% of all recorded failures.

Analysts link the mass extinction event to the market turbulence that defined late 2025. Specifically, the “liquidation cascade” of October 10 wiped out $19 billion in leveraged positions within 24 hours.

The report described the event as the largest single-day deleveraging in crypto history. Deleveraging events of this magnitude remove the speculative bid required to keep low-liquidity meme coins solvent.

Survival Statistics by the Numbers

- Total Failures (2025): 11,564,909

- Total Failures (2024): 1,382,010

- Total Failures (2021-2023): Under 500,000 combined

- 2025 Share of Five-Year Failures: 86.3%

The mortality rate confirms that project durability declined as issuance speed increased. Investors are now navigating a landscape where the vast majority of new assets face total loss within three months of inception.

Chain Street’s Take

The data proves 2025 wasn’t just a bear market. It was the year crypto perfected the “disposable asset.”

The 11.6 million dead coins are not failed startups. They are discarded lottery tickets.

Automated launchpads successfully financialized short attention spans. They reduced the lifecycle of a crypto asset from years to minutes.

The technology performed exactly as designed. The market simply prioritized issuance speed over durability.

We moved beyond building protocols and began manufacturing churn. The “mortality signal” is loud. If you trade tokens with zero barriers to entry, you trade on a countdown timer.