Bitcoin just turned the $90,000 level into a high-stakes crypto battleground. Institutional infrastructure officially replaced retail speculation as the market’s primary engine this week.

On-chain data from Santiment indicates a broad recovery led by Bitcoin, Solana, and XRP. Retail sentiment is shifting as the market prepares for a new liquidity cycle. Whales typically move in silence. Retail commentary across social platforms drives the current social volume.

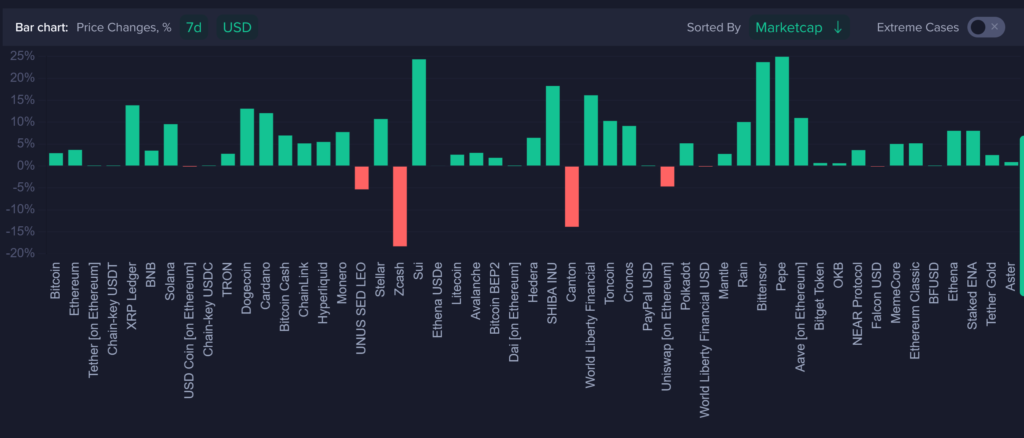

Bitcoin gained 3.0% over the past week despite a mid-week slide. Large net outflows from BlackRock and Fidelity products shaped the price action.

Traditionally “Wall Street” plumbing now functions as a primary driver of short-term volatility. Traders de-risked positions on Thursday ahead of the U.S. jobs report.

Employment data released Friday morning showed modest gains. Retail optimism rises as the bleeding slows.

Many analysts expect more dips into the $80,000 range to create the necessary disbelief required for a major breakout later in the year.

Institutional Expansion and the Solana ETF Pivot

Morgan Stanley accelerated institutional momentum this week. The bank filed with the SEC for exchange-traded funds tied to Bitcoin and Solana on January 6.

The filing positions a major bank to push into spot-style crypto exposure beyond the usual asset-manager crowd. Solana gained 9.6% this week and currently visits the $140 level.

Traders watch the $143 resistance level for a potential breakout. Network hardening defines the growth story for Solana in 2026.

Binance also transitioned to Abu Dhabi Global Market supervision on January 5. Updated operating terms impact confidence as Binance Coin rose 3.5%.

XRP Volatility and Altcoin Sentiment Divergence

XRP jumped 13.9% in the past week before correcting from a high of $2.40. The January escrow unlock concentrated market attention in a short window.

The release of 1 billion XRP saw a large portion reportedly re-locked. Small traders tried to time the bottom during the subsequent correction.

Crowd consensus was incorrect. The asset bled further as dip-buyers got caught in the retreat.

Negative sentiment likely returns if XRP tests the $2.00 mark again. Cardano gained 12.1% on speculation regarding TradFi access.

Rising open interest suggests traders are buying the rumor of a potential ADA ETF decision.

Regulated Leverage and the Meme Sector Rebound

Dogecoin gained 13.1% as meme-coin volatility returned. The 21Shares 2x Long Dogecoin ETF emerged as a top performer.

The product delivered a 39% gain in the first days of 2026. Regulated leverage drove ripple effects on the broader sector.

Shiba Inu and Pepe enjoyed healthy rebounds as speculators returned to high-beta assets. Sentiment toward Dogecoin bottomed on January 1.

The subsequent rally punished panic sellers who exited positions in December. Ethereum sentiment appears scattered. Staking became a mainstream narrative.

ETH gained 3.7% this week as discussion shifted to payouts and distributions tied to staking rewards.

Chain Street’s Take

The professionals are front-running the retail fever. Morgan Stanley filing for Solana and Bitcoin ETFs proves Wall Street plumbing is permanent. Bitcoin de-risking for a jobs report shows crypto is no longer a niche market. It is a macro asset. Leverage returned to the meme sector. The TXXD performance confirms that pros use regulated tools to play the game now. Retailers tried to time the bottom on XRP. The whales moved in silence on Solana. Follow the plumbing, not the social volume.