- The Bitwise Solana Staking ETF (BSOL) is expected to begin trading on the NYSE Arca exchange as early as October 28 following its official certification.

- The launch is proceeding under new streamlined listing rules adopted by the SEC, which allow exchanges to certify funds without direct staff approval during the U.S. government shutdown.

- The U.S. follows international markets, including Hong Kong, Canada, and Brazil, which have already approved and launched spot Solana investment products.

Even as the U.S. government grinds through another shutdown, the New York Stock Exchange is moving ahead with the country’s first spot Solana exchange-traded funds. The Bitwise Solana Staking ETF (ticker: BSOL) is set to list on NYSE Arca on October 28 after the exchange certified its listing under the Securities Exchange Act of 1934; a procedural step that effectively greenlights trading despite the absence of full SEC staffing.

Bitwise Asset Management confirmed its Bitwise Solana Staking ETF (ticker: BSOL) will list on the NYSE Arca exchange on October 28, 2025. The exchange certified its approval for the listing under the Securities Exchange Act of 1934, according to an official notice.

Sol ETFs Staking and Market Context

Bitwise’s BSOL will be among the first altcoin-based SOL ETFs in the U.S. to incorporate staking, a feature native to the Solana network that allows holders to earn yield on locked tokens. The firm said it plans to stake a portion of its SOL holdings to generate additional rewards for investors.

The rollout follows a wave of regulated crypto fund approvals since early 2024, beginning with spot Bitcoin ETFs in January and Ethereum ETFs in May. Bloomberg Senior ETF Analyst Eric Balchunas said in September that a shift in SEC policy and streamlined rules had “meaningfully raised the odds for altcoin ETF approvals.”

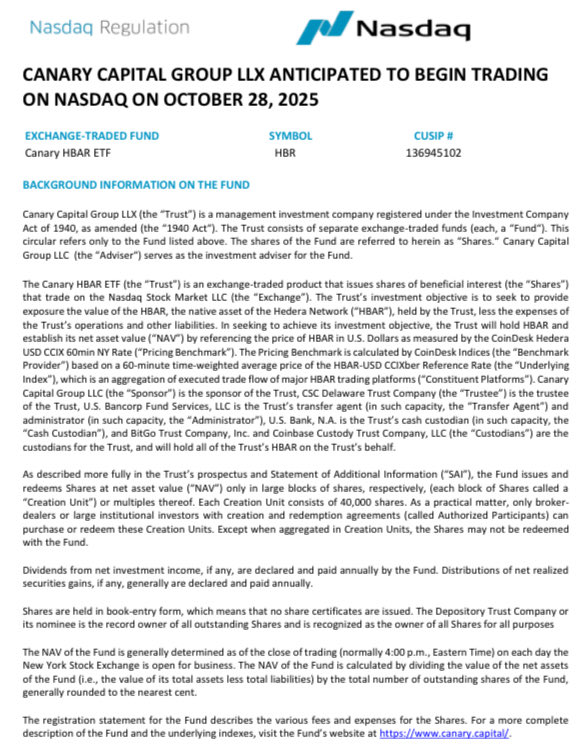

Canary Capital is expected to follow Bitwise with its own listings for Litecoin (LTCC) and Hedera (HBAR) ETFs, according to CEO Steven McClurg. NYSE Arca published listing notices for all three funds on Friday, signaling the most significant expansion of U.S.-regulated digital asset products since the Ethereum ETF launch.

Shutdown Bypassed by New SEC Rules

The timing of these launches underscores how much the ETF approval process has evolved. Under new “generic listing standards” adopted by the SEC in September 2025, exchanges can self-certify certain products that meet strict disclosure and asset criteria, effectively sidestepping the case-by-case approval process that once stalled crypto ETFs for months.

The rules have allowed issuers to move forward even as the SEC operates with limited staff during the shutdown. In late September, the agency withdrew multiple delay notices for pending crypto ETF applications, including Solana filings from Bitwise, VanEck, Fidelity, Canary, 21Shares, and Invesco Galaxy.

International SOL ETFs Precedent

The U.S. is catching up to global peers. Canada approved its first Solana ETFs in April 2025, while Brazil’s securities regulator cleared a spot Solana fund from QR Asset Management in August 2024.

Hong Kong followed on October 27, 2025, when China Asset Management launched its Solana ETF with a 0.99% management fee. Analysts at JP Morgan project the Hong Kong fund could attract up to $1.5 billion in net inflows during its first year, according to data from Xangle.

Chain Street’s Take

The NYSE’s move to certify spot Solana ETFs without full SEC review marks a quiet but pivotal shift in U.S. financial oversight. For the first time, crypto funds are being operationalized through rules-based listing frameworks rather than case-by-case political decisions, a step that effectively places Solana alongside Bitcoin and Ethereum in the regulated ETF hierarchy.

If the rollout draws even a fraction of the inflows seen in Bitcoin and Ethereum ETFs, it could legitimize staking-based assets as a new category of U.S.-regulated yield products, and cement Solana’s role as the third pillar of institutional crypto exposure.