On-chain data shows 216 million XRP exited exchanges while whale wallets reduced holdings by 10 million XRP, reflecting mixed positioning ahead of debut

The first spot XRP exchange-traded fund for U.S. investors begins trading Thursday on Nasdaq, with Canary Capital’s XRPC product marking expansion in regulated cryptocurrency exposure following recent Solana, Litecoin, and Hedera ETF launches.

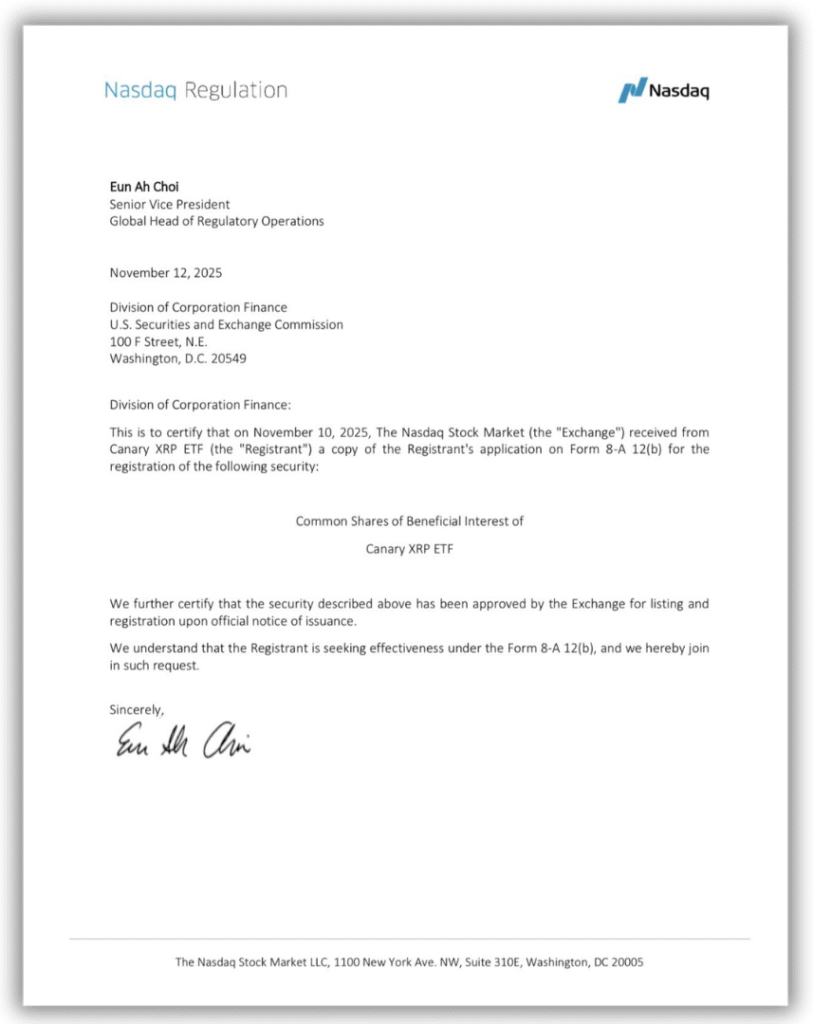

Nasdaq completed certification of the fund on Thursday, according to a letter filed with the Securities and Exchange Commission by the exchange’s Eun Ah Choi. The certification confirms completion of all regulatory steps required for trading to commence.

Auto-Effective Registration Expedites Market Access

Canary Capital utilized auto-effective registration under Section 8(a) of the Securities Act of 1933 to expedite the digital asset investment product launch. The firm filed Form 8-A with the SEC on Thursday, triggering a 20-day window for automatic approval unless the regulator objected. The timing coincided with reduced SEC activity due to a government shutdown that ended November 12.

Altcoin ETF Momentum Builds Institutional Appetite

The launch extends recent expansion in altcoin-focused investment products. Bitwise’s Solana ETF recorded $56 million in first-day trading volume on October 28, rising to $72 million on its second day, according to fund issuer data. REX-Osprey’s XRP futures-based ETF, launched in September, attracted $24 million in trading volume within its first 90 minutes and surpassed $100 million in assets under management by October.

As of November 13, the Depository Trust & Clearing Corporation lists eleven XRP ETF products including filings from Bitwise, Franklin Templeton, 21Shares, and CoinShares. The surge reflects growing institutional confidence following SEC guidance on crypto asset exchange-traded products released in July 2025.

Mixed On-Chain Signals Show Divergent Positioning

On-chain activity shows divergent behavior among investor cohorts. According to Glassnode, more than 216 million XRP, valued at approximately $556 million, exited centralized exchanges during the week before certification. Exchange outflows typically signal investors moving tokens to self-custody for longer-term holding.

However, whale wallets holding between 1 million and 10 million XRP reduced holdings by approximately 10 million XRP in the two days before launch, according to on-chain tracking data. Long-term holders sold 135.8 million XRP by November 10, marking a 32% increase in daily outflows since early November.

The divergence between retail accumulation and large holder distribution may reflect expectations of a “sell the news” event, a pattern observed in previous cryptocurrency ETF launches. XRP traded near $2.39 during Asian market hours on November 13, declining 0.4% following the certification announcement. The launch occurs during increased regulatory clarity for digital assets following conclusion of Ripple’s legal dispute with the SEC.

Chain Street’s Take

The XRPC debut establishes operational precedent for spot altcoin ETFs using auto-effective registration during periods of reduced regulatory staffing. With eleven products awaiting exchange certification and institutional capital rotating beyond Bitcoin and Ethereum, the XRP ETF wave tests whether regulated token custody structures can absorb meaningful institutional allocation without triggering sustained price volatility. Early trading volume and whale behavior in the first 30 days will signal whether institutional demand matches retail anticipation built during the approval cycle.