While crypto-Twitter argues over whether Justin Sun or World Liberty Financial (WLFI) crossed the bigger line, another audience is watching more closely: regulators in Washington.

The Trump-linked DeFi project’s move to freeze Sun’s holdings — worth hundreds of millions — may go down less as a crypto feud than as a regulatory case study. By proving its developers could blacklist wallets at will, WLFI just gave the SEC its clearest evidence yet that “decentralized” finance often works like a centralized securities issuer in disguise.

Key Points

- SEC’s Dream Exhibit: WLFI’s wallet freeze shows unilateral control, reinforcing the SEC’s view that DeFi projects act like centralized issuers.

- Exchange Conflicts: Sun is accused of using HTX liquidity to skirt restrictions — a scenario regulators compare to FTX’s collapse.

- Credibility Crisis: The feud reveals that “code is law” is a myth; centralized power remains the final backstop in DeFi.

Vigilante Justice in DeFi

The question of whether Sun tried to dump tokens early almost misses the point. The market-moving moment came when WLFI’s developers stepped in.

In traditional finance, freezing assets requires due process: a judge, evidence, and oversight. WLFI skipped all of that. Its team made an accusation and executed the punishment in one motion — blacklisting Sun’s wallet.

The move may have shielded retail holders from a whale dump, but it shattered the project’s claim to decentralization. For regulators, it looked less like an open protocol and more like an unlicensed financial institution enforcing insider rules.

As Camila Russo, founder of The Defiant, noted, the move made a mockery of the project’s branding: “…so much for their decentralization pitch etc..”

Echoes of FTX: The Exchange Conflict

Another piece of the story is Sun’s exchange, HTX. WLFI alleged that he used its liquidity pools to borrow against locked tokens, effectively giving himself early access to sell.

If that’s true, the parallels to FTX are obvious: an exchange insider exploiting infrastructure for personal advantage, blurring the line between operator and participant.

Adam Cochran, an investor and investigative journalist, was blunt. He called Sun a “money launderer/conman” who poured nearly $100 million into Trump-linked crypto projects before the DoJ “suddenly dropped” its investigations into him. On X, he added that when you strike deals with someone with “30+ years of screwing over partners, it’s a case of FAFO.”

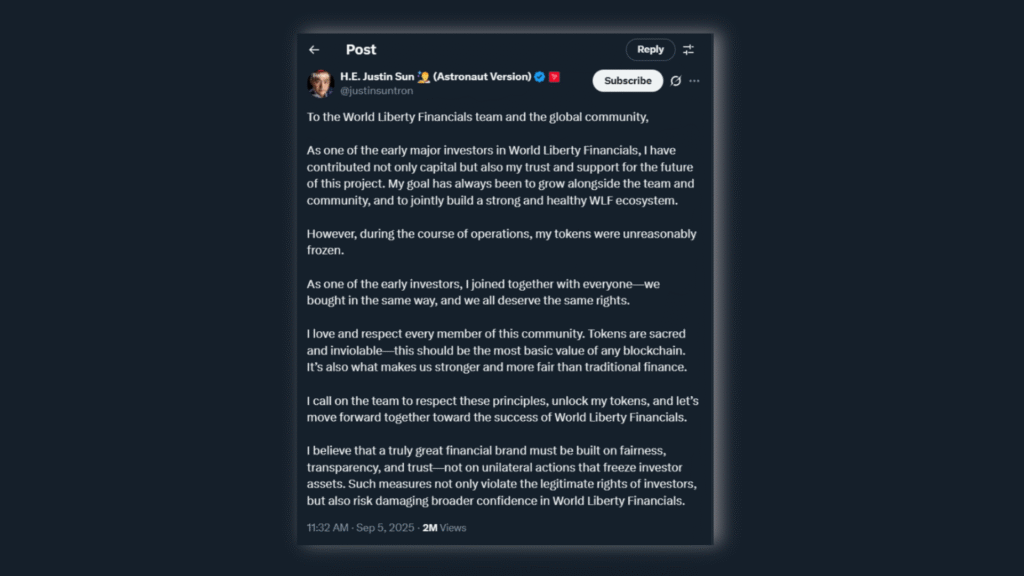

Sun denied wrongdoing, describing the transfers as “test transactions.” He accused WLFI of betraying DeFi’s principles and demanded his tokens be unlocked.

Why Washington Is the Real Audience

This feud won’t just be remembered as another crypto spat. It drops directly into a policy fight in which the SEC and other agencies argue that DeFi isn’t decentralized at all.

WLFI’s actions backed that claim. A small group of insiders proved they had the authority to freeze, punish, and protect — exactly what securities regulators point to when they call these projects centralized. Meanwhile, Sun’s alleged use of exchange power validates long-standing concerns about conflicts of interest and systemic risk.

For policymakers, this isn’t about personalities. It’s about evidence.

ChainStreet’s Take

Forget the theatrics on social media. The WLFI-Sun feud is a gift to regulators. WLFI exposed its central switch, undermining DeFi’s decentralization pitch in one stroke. Sun confirmed fears about conflicted exchanges, echoing FTX’s collapse.

Together, they’ve handed Washington its strongest case yet for tougher DeFi oversight. WLFI may have defended its token price at the moment, but it torched DeFi’s credibility in the halls of power — and that’s what investors and policymakers will remember.