A Bitcoin OG is unloading thousands of coins at breakneck speed, pouring nearly $4 billion into Ethereum in what could be one of the most dramatic pivots in crypto history.

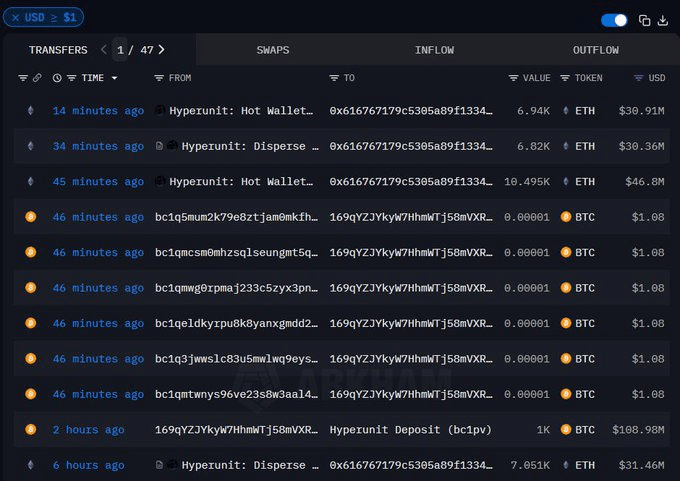

The whale-sized transactions, tracked by on-chain analytics firm Nansen, show a deliberate and sustained pivot out of the original cryptocurrency and into its biggest rival. Over the past 20 hours alone, the entity sold roughly $435 million worth of Bitcoin and immediately used the proceeds to acquire 96,850 ETH, valued at $432 million.

This latest move is part of a much larger campaign. In less than two weeks, the same whale has sold over 32,000 BTC, buying up more than 870,000 ETH in a series of colossal trades totaling nearly $3.8 billion.

Key Points

- The Great Rotation: An unidentified Bitcoin OG has sold more than 32,000 BTC and acquired over 870,000 ETH in under two weeks.

- Overnight Move: The most recent transaction saw 4,000 BTC ($435M) rotated into nearly 97,000 ETH ($432M).

- More to Come? The wallet still holds 50,000+ BTC, worth $5.4B at current prices.

A Conviction Trade at Scale

This is not your ordinary portfolio rebalance. It’s one of the largest and most concentrated Bitcoin-to-Ethereum rotations by a single entity ever recorded.

The “OG” status suggests the whale acquired its trove of BTC in the early, formative years of the network. A pivot of this magnitude is widely interpreted as a long-term bet on Ethereum’s DeFi, NFTs, and smart-contract economy over Bitcoin’s position as a pure store of value.

Market analysts are now fixated on the whale’s remaining 50,000+ BTC, worth $5.4 billion. The trading pattern suggests this entire position could eventually move, a shift that would carry major implications for liquidity, sentiment, and the balance of power in digital assets.

What’s at Risk for Bitcoin

In a market driven by narratives, this trade is a story in itself. When one of Bitcoin’s earliest believers pivots billions into Ethereum, it signals a powerful thesis about where the future of crypto is being built.

Sustained sell-side pressure from this whale could weigh on Bitcoin’s price, while the corresponding ETH accumulation provides a significant tailwind. For traders and institutions, the whale’s wallet has become a live macro indicator—a public signal of a changing of the guard in digital assets.

ChainStreet’s Take

This is capital allocation on a nation-state scale, executed by a single crypto native. The rotation from a non-productive, store-of-value asset (BTC) to a productive, yield-bearing economic engine (ETH) is one of the clearest signals yet about where sophisticated capital sees growth.

The remaining 50,000 BTC is the elephant in the room. If that capital moves too, it won’t just be another trade—it will be the definitive statement that Ethereum, not Bitcoin, is where the next era of crypto is being built.