The collapse of Venezuela under the leadership of Maduro, has triggered a global search for a purported $60 billion cryptocurrency stockpile.

Financial analysts and intelligence reports suggest the former administration utilized a complex laundering network to convert national resources into Bitcoin (BTC). The strategy aimed to evade international sanctions and protect state wealth from U.S. Treasury freezes.

The speculation centers on a report titled “The $60 Billion Question” published on January 3 by Whale Hunting. The analysis utilizes human intelligence gathered after the regime’s fall.

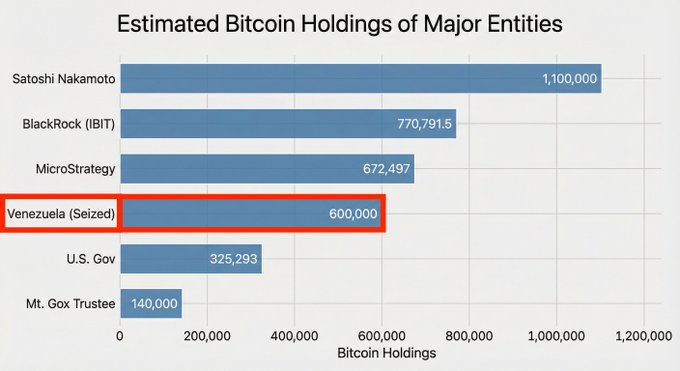

It estimates the state controlled approximately 600,000 BTC. The estimate places Venezuela among the largest Bitcoin holders in the world, potentially rivaling the institutional holdings of BlackRock.

Venezuela: Gold-to-Crypto Pipeline

The forensic basis for the hoard begins with verified gold sales from 2018. Historical data from Reuters and The Wilson Center confirms the Maduro administration liquidated approximately 73 tons of gold that year.

These sales to the United Arab Emirates and Turkey generated roughly $2.7 billion in capital. Intelligence reporting suggests this capital moved immediately into Bitcoin.

Trading prices for Bitcoin in 2018 ranged between $3,000 and $10,000. If the regime converted the full $2.7 billion, that single tranche would account for roughly 400,000 BTC.

At current prices near $90,000, those coins represent a $36 billion valuation.

Oil Revenues and the Tether Wash

The remainder of the estimated balance stems from more recent energy exports. A 2024 Reuters report detailed how the state oil firm, PDVSA, began requiring 50% prepayment in the stablecoin Tether (USDT).

Industry analysis from Chainalysis and Binance Research in late 2025 indicated that nearly 80% of oil exports moved through similar digital channels by the end of the year.

Laundering techniques obfuscated the trail by “washing” these USDT funds into Bitcoin using mixing services. Such activity makes on-chain verification currently impossible.

Venezuela’s government historically avoided public disclosures of its digital asset holdings to protect its financial lifelines from Western intervention.

Barriers to Recovery and Market Risks

Securing these assets is not a certainty for the new administration or U.S. authorities. Seizing the Bitcoin requires access to private keys or seed phrases.

These were likely held by high-ranking officials now in hiding. The situation creates a “Frozen Asset” scenario where billions in capital could remain inaccessible indefinitely.

Market participants are weighing the implications of such a massive hoard. Some analysts argue that a U.S. seizure would effectively lock up 3% of the global supply for years during legal proceedings.

This would create a bullish supply shock. Others warn of a potential fire sale that could crash prices if a new government attempts to liquidate the assets quickly to fund humanitarian relief.

Recovery of these funds remains a primary goal for interim leadership. The technical and legal hurdles are unprecedented in the history of sovereign asset forfeiture.

Chain Street’s Take

The numbers are the mathematical result of eight years of survivalist hoarding. Whether the total is 600,000 BTC or 60,000 BTC, the narrative holds.

Venezuela proved that Bitcoin is the only asset class liquid enough to hide a nation’s wealth and unfreezable enough to survive a total blockade. The same technology used to hide the money provides the forensic trail that now haunts the former leadership.

We are watching the first high-stakes hunt for a sovereign seed phrase. If the U.S. secures the keys, the Strategic Reserve just found its founding capital. If the keys are lost, 3% of the Bitcoin supply just went to a digital grave.