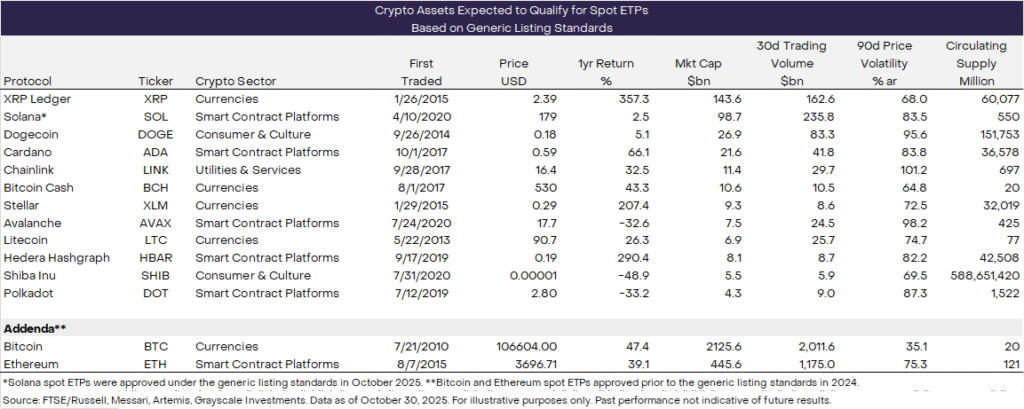

- Grayscale’s Market Byte: Here Come the Altcoins report (Oct. 31, 2025) lists Shiba Inu (SHIB) among digital assets eligible for a U.S. exchange-traded product (ETP) under the SEC framework.

- The report marks the first instance where SHIB was formally included in Grayscale’s ETP eligibility list.

- Coinbase listed SHIB futures on its derivatives platform in July 2024, a development viewed by market participants as a regulatory precursor to potential ETP consideration.

The possibility of a first SHIB ETP in the United States is getting bigger after Grayscale’s Market Byte: Here Come the Altcoins report, published October 31, 2025, named Shiba Inu among assets eligible for listing under the U.S. Securities and Exchange Commission’s (SEC) new exchange-traded product framework.

Grayscale’s ETP Criteria Highlights Shib ETP Possibility

The report evaluated more than 80 crypto assets based on liquidity, decentralization, custody readiness, and regulatory risk. SHIB ETP eligibility places the token alongside Ethereum Layer-2 and DeFi projects like Ripple (XRP), Chainlink (LINK), and Cardano (ADA), which Grayscale says exhibit “sufficient market maturity and investor demand.”

Inclusion on the list doesn’t guarantee a product launch, but it does signal institutional confidence. Grayscale’s screening framework has historically served as a leading indicator for which tokens eventually gain traction in regulated fund structures.

Coinbase Derivatives Listed SHIB Futures in 2024

On July 15, 2024, Coinbase Derivatives Exchange listed SHIB futures contracts following approval under Market Notice 24-14.1. Each contract represented 10 million SHIB, priced at 1,000 times the underlying token value, and settled in cash based on the Market Vector Coinbase SHIB benchmark rate (CBSHIB).

According to Coinbase’s filing, the futures listing was intended to provide a regulated trading instrument for market participants seeking exposure to SHIB price movements without direct spot holdings. The listing placed SHIB alongside other derivatives such as Polkadot (DOT) and Chainlink (LINK).

Meme Coin Narrative Gains Institutional Footing

The mention of Shiba Inu in Grayscale’s report adds legitimacy to a token once dismissed as a speculative meme. Analysts note that a potential SHIB ETP could mirror the retail-to-institutional shift seen in Dogecoin during the early stages of crypto ETF adoption.

CoinMetrics data show SHIB’s transaction volumes have remained resilient through 2025, ranking among the top ERC-20 assets by network activity. Institutional ETP eligibility for SHIB represents the convergence of community-driven value and traditional market infrastructure.

Chain Street’s Take

Grayscale’s recognition of Shib ETP readiness marks a subtle shift in how institutions view the dog-themed meme coin. A SHIB ETP would blur the line between retail culture and Wall Street legitimacy, signaling that speculative assets can evolve into regulated, tradable instruments under the SEC’s evolving framework.