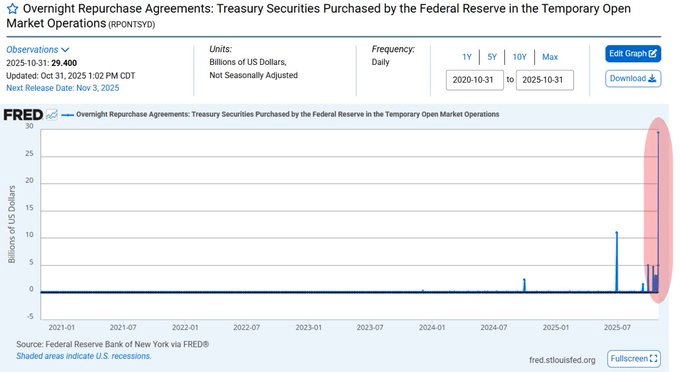

The Federal Reserve injected $50.35 billion into the U.S. banking system on October 31 through its Standing Repo Facility (SRF), marking the largest single-day operation since the tool’s launch in 2021. The record draw underscores mounting liquidity pressures in short-term funding markets, and has drawn close attention from crypto analysts tracking potential ripple effects across risk assets.

Fed Liquidity Boost Highlights Tightening Funding Conditions

The $50.35 billion operation on October 31 consisted of two repo transactions, according to daily reports from the Federal Reserve Bank of New York. The Fed lent against $29.4 billion in Treasuries, $0.5 billion in agency securities, and $20.95 billion in mortgage-backed securities (MBS.

The spike in Standing Repo Facility (SRF) usage reflects intensifying liquidity stress within the U.S. banking system. Total reserves have dropped to approximately $2.8 trillion, the lowest level since 2020, according to Fed data. Analysts attribute the decline to the Federal Reserve’s ongoing quantitative tightening (QT) program, which has withdrawn over $1.5 trillion from the financial system since 2022.

The SRF, introduced in 2021, allows banks and primary dealers to borrow cash overnight in exchange for high-quality collateral such as Treasuries and agency-backed securities. Its use typically increases when short-term funding markets tighten or when demand for reserves outpaces supply, a signal of systemic liquidity stress.

Dallas Fed President Lorie Logan warned in an October speech that if elevated repo rates persist, the central bank may need to resume asset purchases to stabilize reserves. The Fed confirmed during its October 2025 Federal Open Market Committee (FOMC) meeting that QT will conclude by December 1, and that it will begin reinvesting maturing Treasuries to maintain balance sheet stability.

Crypto Markets Track Liquidity Flows for Potential Impact

The record SRF usage quickly drew attention across digital asset markets. Analysts on X, including former trader Pablo Heman, described the move as an early sign of a policy shift. Heman wrote on November 1: “The Fed pumped $50.35B into the banking system yesterday! … QE is coming even though the Fed rate is STILL at 3.75–4%.”

Financial data provider Barchart also highlighted the scale of the operation, noting that the Treasury component surpassed repo peaks last observed during the dot-com era. Bull Theory, a crypto research account, commented that “liquidity stress is building behind the scenes,” drawing comparisons to 2019, when Fed interventions coincided with a surge in Bitcoin’s price.

While the analytical sentiment was broadly positive, digital asset markets showed limited immediate reaction. Bitcoin traded near $70,000 on November 1, slipping 0.5% amid broader equity weakness, according to CoinMarketCap data. Ethereum held steady around $3,500.

Some observers suggested that increased dollar liquidity could boost investor interest in alternative assets such as Bitcoin and Ethereum, particularly as funding conditions ease. According to Binance data, total crypto derivatives open interest stood at $40 billion in October, suggesting traders remain positioned for volatility.

Analysts say sustained SRF usage above $20 billion daily would indicate persistent stress in short-term funding markets. If that pressure continues into late November, it could confirm systemic tightness that historically precedes longer-term bullish cycles in risk assets, including cryptocurrencies.

Chain Street’s Take

The record $50.35 billion repo operation underscores growing tension between the Fed’s liquidity management and market stability. While crypto traders view the surge as a signal of easing financial conditions, the underlying stress in short-term funding suggests the system remains fragile. Whether this injection marks the start of a broader liquidity pivot will depend on how reserves and repo demand evolve through December.