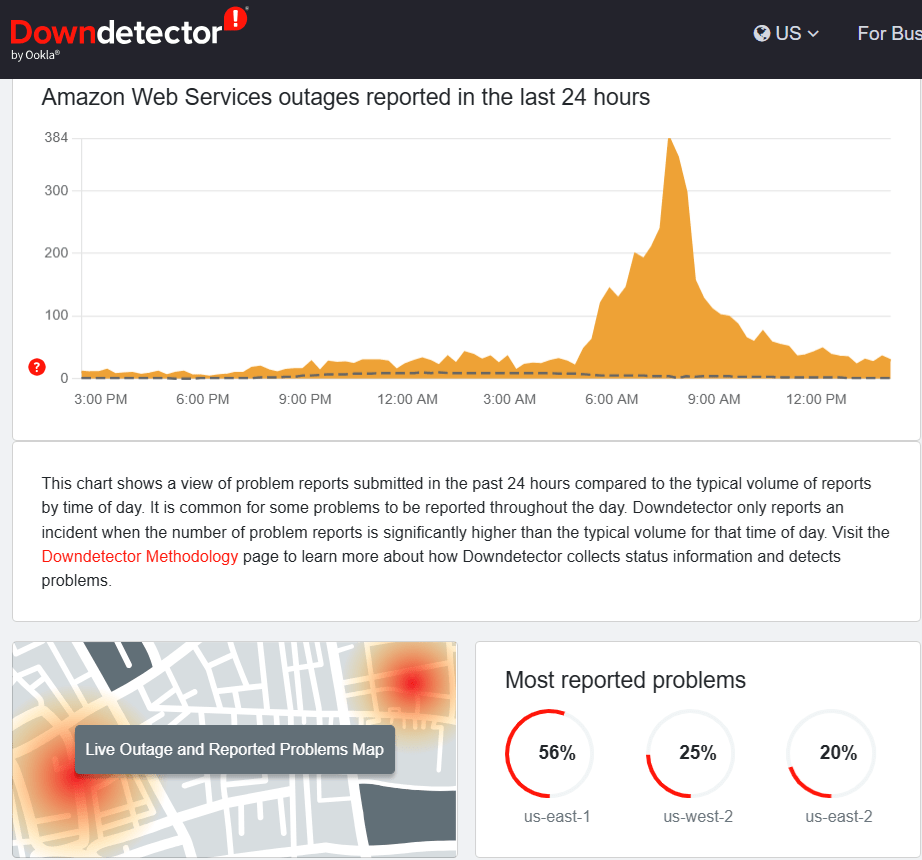

User reports detailing server connection failures and login issues on Amazon Web Services (AWS) systems peaked on Saturday, according to data from Downdetector. The elevated complaints, primarily focused on U.S. East regions, occurred weeks after a major, confirmed outage in late October, intensifying scrutiny on cloud centralization risks across finance and digital assets.

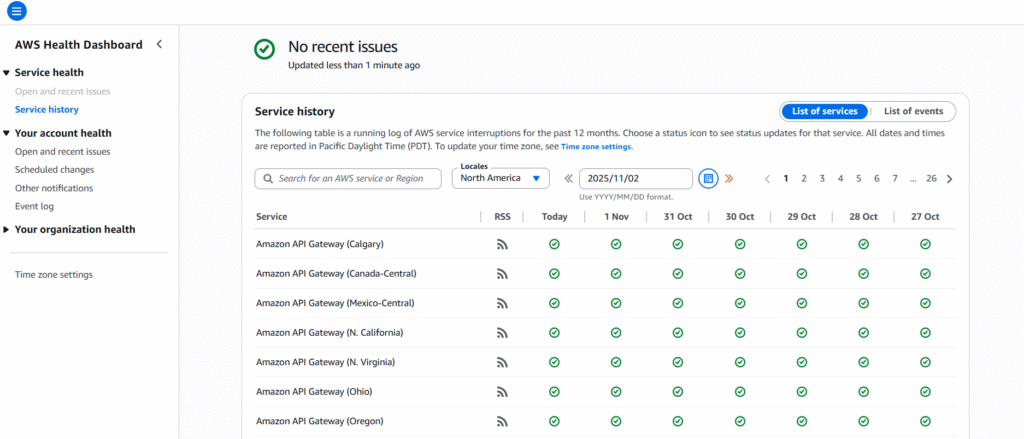

AWS Health Dashboard showed its services remained operational throughout the period.

Downdetector Reports vs. AWS Official Status

Downdetector recorded elevated user reports Saturday, reaching a peak around 6:49 PM EDT. According to Downdetector data analyzed for the disruption period, 56% of reported problems centered on the critical us-east-1 region.

The us-west-2 region accounted for 25% of reports, while 20% were attributed to us-east-2. Common issues cited included server connection failures and account access problems, according to Downdetector.

However, the AWS Health Dashboard logged no outages as of November 1, stating that all services were operational by the evening. In a support tweet, the @AWSSupport account on X advised users on tracking resources for unexpected issues, relevant for addressing potential user-side attributions.

Crypto and Financial Services Reliance Amid Failures

The elevated service reports triggered disruptions for crypto platforms dependent on AWS infrastructure. Coinbase users reported experiencing withdrawal errors during the period.

On X, user @Lordsmiththegod posted on Sunday that they couldn’t withdraw funds due to a “parameter error” on Coinbase, attributing the issue to AWS problems. Industry reliance on the cloud giant is high.

Platforms like Coinbase, which rely on AWS for API and hosting, these events highlight vulnerabilities to single-point failures. While no on-chain data was affected, past analysis suggests similar outages could disrupt trading volumes potentially by 10% to 20%.

User reports also cited delayed services for gaming platforms and retail services like Netflix and Slack.

Chain Street’s Take

The latest wave of AWS user-reported disruptions underscores a growing structural risk in the digital economy: cloud dependency concentration. While official AWS dashboards show operational stability, external reporting tools like Downdetector reveal periodic disconnects between user experience and provider data.

For industries such as crypto, finance, and real-time trading, where milliseconds of downtime can halt billions in transactions, these incidents highlight the fragility of centralized cloud infrastructure. The recurring nature of the disruptions suggests the need for redundant, decentralized, or hybrid cloud strategies to mitigate systemic exposure.