The a16z Crypto Report 2025 declares this the year crypto went mainstream, as stablecoins move trillions, institutions go on-chain, and blockchain infrastructure reaches industrial scale.

In Brief

- Crypto Report 2025 finds stablecoin settlements hit $46 trillion, signaling mass adoption.

- Institutional crypto products now hold $175 billion in on-chain assets.

- Core blockchains reach 3,400 transactions per second with sub-cent fees.

Crypto Report 2025 Marks the Shift From Speculative to Systemic

At a JPMorgan trading desk in New York, a tokenized dollar settled on-chain for the first time. The moment captured what Crypto Report 2025 from a16z argues: crypto officially went mainstream.

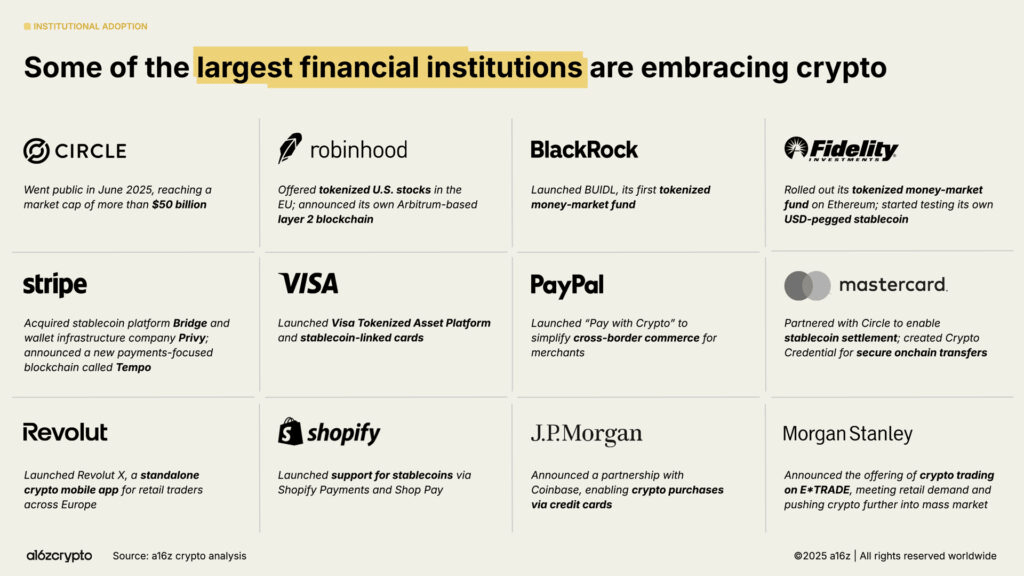

According to the report, 2025 marks the point when finance stopped treating crypto as an experiment and started treating it as infrastructure. BlackRock’s iShares Bitcoin Trust (IBIT) crossed $30 billion in assets.

JPMorgan, Visa, and Fidelity scaled tokenization pilots across multiple markets. Altogether, exchange-traded crypto products now hold more than $175 billion, up 169 percent from 2024. Active on-chain users reached between 40 and 70 million, about 10 million more than last year.

The report estimates roughly 716 million people worldwide now hold crypto, reflecting broad awareness even if daily usage remains limited.

Stablecoins and Infrastructure Lead the Mainstreaming of Crypto

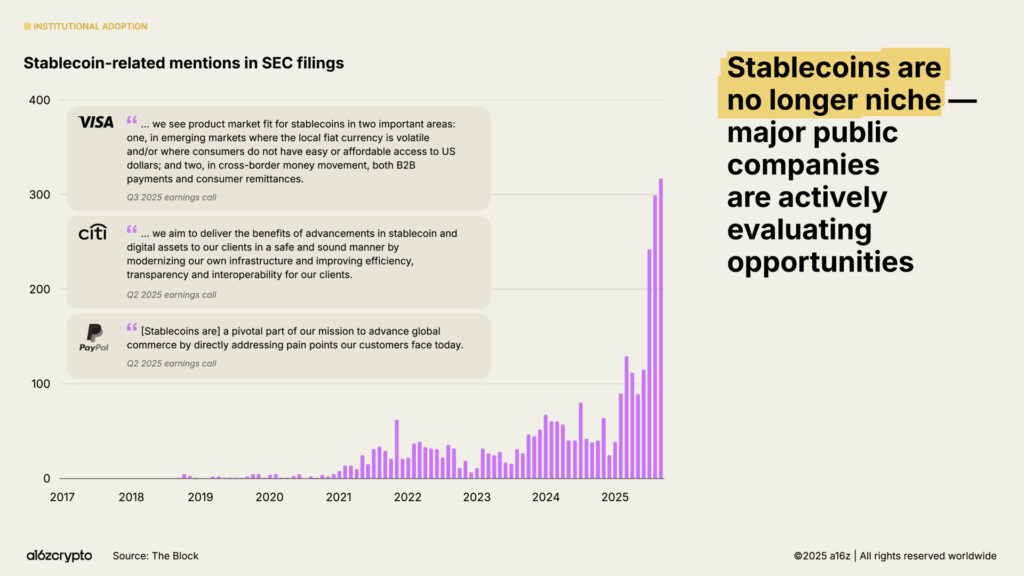

The Crypto Report 2025 highlights stablecoins as crypto’s clearest mainstream success. Over the past year, stablecoins processed $46 trillion in transactions, or $9 trillion when adjusted for internal flows, rivaling major payment and settlement systems.

More than 1% of U.S. dollars are now tokenized, and stablecoin issuers collectively rank among the top 20 holders of U.S. Treasuries. “The cheapest way to send a dollar today is with a stablecoin,” the report notes.

Meanwhile, networks like Ethereum, Solana, and Base now handle a combined 3,400 transactions per second, with fees under one cent. The report credits modular scaling and zero-knowledge proof technology for unlocking industrial-scale throughput.

Policy and Market Integration Reinforce the Findings of Crypto Report 2025

The Crypto Report 2025 also points to growing policy normalization. The bipartisan GENIUS Act and a new federal task force have integrated digital-asset oversight into existing U.S. financial regulation.

Central banks in Singapore and Brazil began cross-border settlement pilots using tokenized deposits, while the European Union completed MiCA implementation, aligning its crypto rules with broader capital-markets standards.

Chain Street’s Take

Crypto went mainstream in 2025, not through hype, but through measurable integration. The Crypto Report 2025 shows crypto operating inside global systems, in payments, portfolios, and policy. The next question isn’t whether crypto matters, but how it evolves inside the financial structure that’s forming around it.