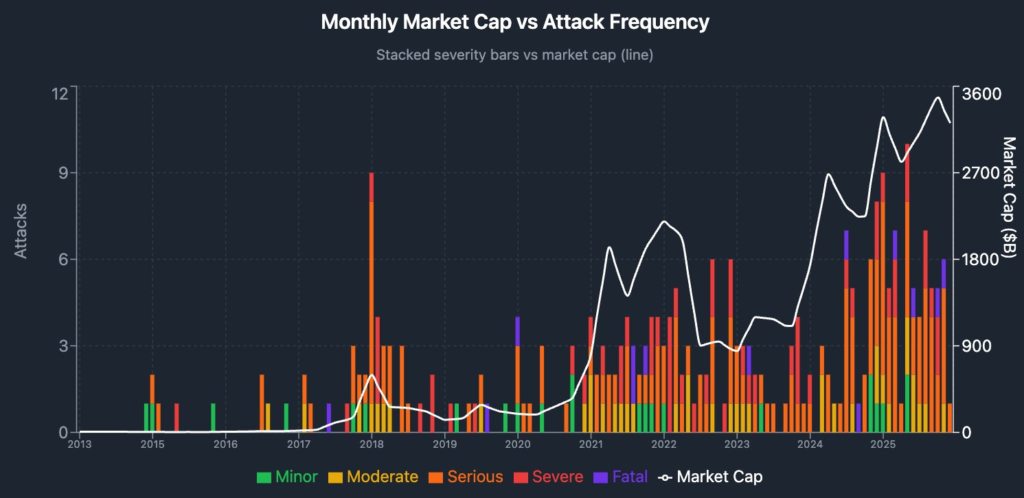

Physical violence against cryptocurrency holders rises in direct proportion to the sector’s market capitalization. This correlation signals a shift in security risks from digital exploits to kinetic coercion. Haseeb Qureshi, Managing Partner at Dragonfly, released an analysis Monday showing that “wrench attacks” are driven by the scale of wealth creation rather than a failure of individual security.

Qureshi utilized a database of violent incidents maintained by Casa co-founder Jameson Lopp. Statistics show a 0.45 R-squared correlation between total crypto market capitalization and reported physical attacks. Nearly half of the variance in violence stems simply from the rising value of the underlying assets.

Adoption vs. Statistical Risk

Individual users face a lower probability of being targeted now than in the industry’s early years despite the increase in absolute incident counts. Coinbase Monthly Active Users (MAUs) serve as a proxy for global adoption in the study.

The user base expanded 60-fold, growing from 2 million in 2015 to 120 million in 2025. Adjusting for this population growth shows the rate of violence per user remains significantly lower than the peaks observed in 2015 and 2018.

“Wrench attacks are becoming more frequent and more violent,” Qureshi stated. “Population effects drive some of this because more people hold crypto now. The risk per user has not increased as much as it might seem.”

Geographic Divergence in Severity

Threat levels vary significantly by region. North America remains the safest major geography for digital asset holders even with a recent uptick in absolute terms.

Western Europe and the Asia-Pacific (APAC) regions currently experience the sharpest increases in the severity of crypto-related physical violence.

The average incident has become more violent over time. Criminals increasingly target high-net-worth individuals who have successfully secured their digital footprints but remain physically vulnerable.

The Arbitrage of Theft

Recent findings underscore an evolution in the economics of theft. Institutional custody and multi-signature wallets have become the industry standard.

These measures raised the cost of executing a digital hack. Consequently, criminals are pivoting to physical coercion. The cost of a “wrench attack” is lower for the attacker than the cost of bypassing modern encryption.

Qureshi advised high-net-worth holders to separate funds across multiple devices and avoid signaling wealth in public. Investing in physical security may become a necessary cost of doing business in high-risk jurisdictions.

Chain Street’s Take

The data reveals a dark irony. Cybersecurity won, so physical security is now the bottleneck.

The industry spent a decade making the ledger unhackable only to realize that the human holding the private key is soft. As the market cap climbs toward $10 trillion, the “wrench attack” becomes a simple arbitrage trade.

Criminals are taking the path of least resistance. In 2026, your most important firewall isn’t software. It is your own anonymity. If they don’t know you have it, they can’t bring a wrench to your door.