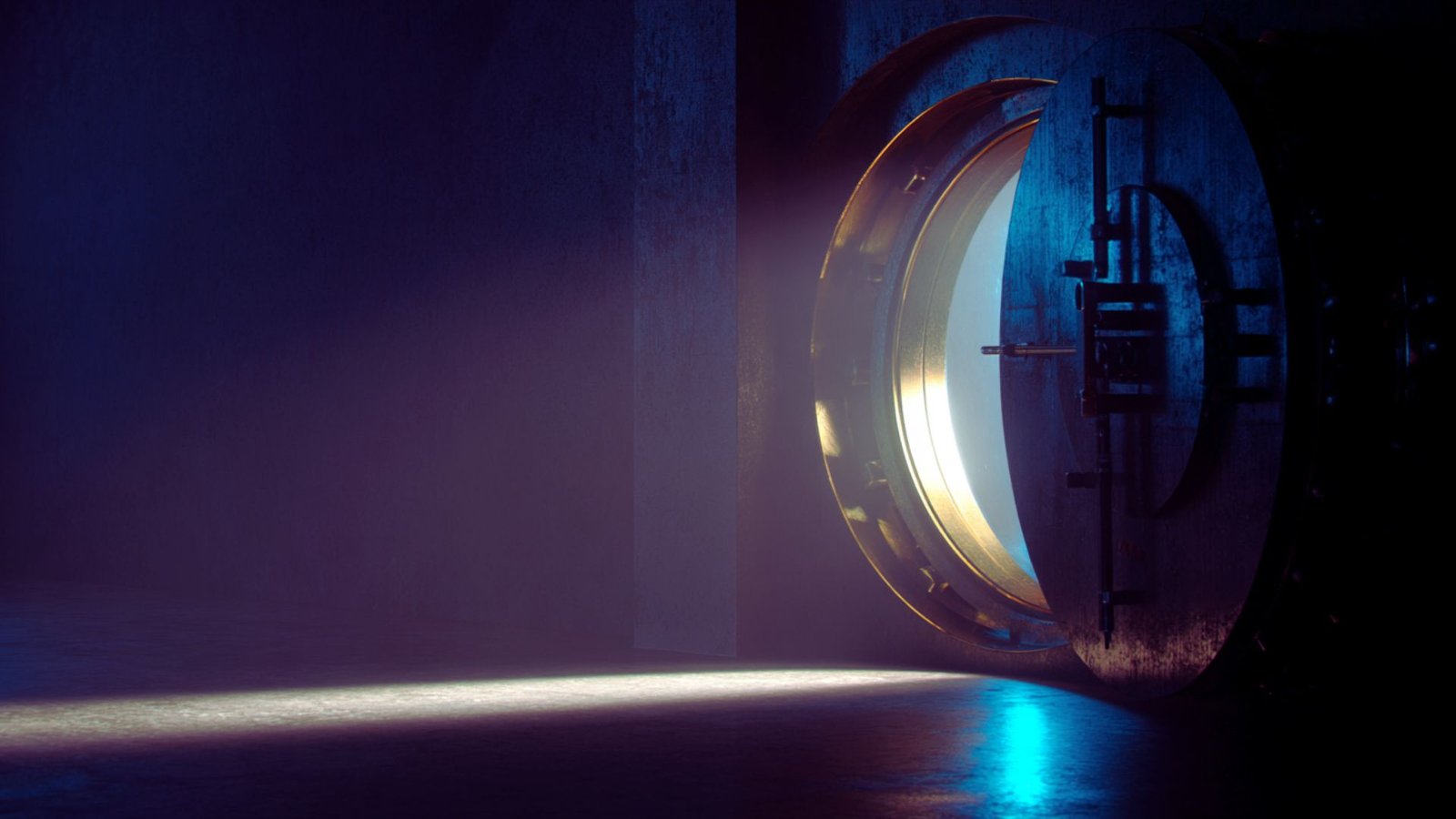

President Trump has cracked open America’s retirement vault, ordering regulators to clear a path for Bitcoin, private equity, and other alternative assets inside 401(k) plans—a $12.5 trillion pool that’s long been off-limits.

The August 7 executive order directs the Department of Labor to revisit its fiduciary guidance under the Employee Retirement Income Security Act (ERISA) within 180 days. For decades, ERISA’s “prudent man” rule has kept high-volatility, illiquid investments out of the 90 million defined-contribution plans it governs. Trump’s order aims to change that.

It’s a sharp reversal from Biden-era policy, which in 2022 told plan sponsors to exercise “extreme caution” with crypto. It also builds on a string of pro-digital-asset moves from the Trump administration, including last month’s passage of the GENIUS Act for stablecoins—part of a broader bid to anchor the U.S. as the global hub for digital finance.

Markets reacted instantly. Bitcoin jumped nearly $800 to reclaim $116,000, while Ether climbed 4%. The news gave a lift to financial heavyweights like BlackRock and Apollo, which are already working on 401(k) products that blend stocks, bonds, and private-market bets. BlackRock has a target-date fund with a 5–20% private allocation planned for 2026.

Caution to Capital: The Fiduciary Tightrope

For crypto advocates, the order is a milestone. But getting Bitcoin into a company retirement plan isn’t as simple as flipping a regulatory switch. The core hurdle is fiduciary risk.

Plan sponsors—the employers offering 401(k)s—are legally obligated to protect participants’ savings. Critics, led by Senator Elizabeth Warren, argue that crypto’s volatility, complexity, and high fees make it unfit for ordinary retirement savers. A mistimed allocation could wipe out years of gains.

The executive order kicks off a rulemaking process that could run for years. Even then, adoption will hinge on corporate boardrooms, not just Washington.

The ChainStreet Take

Forget the image of a teacher day-trading memecoins between classes. The real play here is a newly paved regulatory highway for Wall Street to bundle up illiquid, high-fee assets and push them into the stickiest investor base in America—its retirement savers.

The immediate beneficiaries aren’t the people contributing to their 401(k)s every payday. They’re the asset managers—BlackRock, Apollo, and the rest—who now have a fresh channel to tap capital that sits still for decades and can be billed handsomely along the way.

Even so, the shift is historic. Crypto has moved from the fringe into the same policy frame as mutual funds and blue-chip stocks. The real question is whether retirees are ready for that volatility—or if they’re about to become the cash-out point for the last cycle’s winners.