A Bitcoin wallet that had remained dormant for over five years transferred approximately $444 million in BTC to Binance early Monday morning, initiating one of the largest single-exchange inflows of the quarter.

The transaction, flagged by blockchain tracker Whale Alert, involved the movement of roughly 3,800 BTC from a cold storage address active since 2020. While transfers of this magnitude to centralized exchanges have historically signaled impending retail sell-offs, market analysts argue this movement aligns with a broader trend of liquidity replenishment for over-the-counter (OTC) institutional desks.

The Liquidity Gap

The inflow comes as Bitcoin reserves on major exchanges have fallen to their lowest levels since 2022. According to data from CryptoQuant, the total circulating supply held on trading platforms has dropped for eight consecutive months, tightening the liquidity available for immediate spot settlement.

This scarcity has forced exchanges to source deep liquidity from “legacy” whales to meet the demand from spot ETF issuers and sovereign wealth funds.

“We are witnessing a structural rotation,” said a lead analyst at Glassnode in a Monday note. “The velocity of coins aged 5 to 7 years is increasing, but these assets are not lingering in order books. They are being absorbed by custodial wallets within hours of hitting the exchange, indicating pre-arranged OTC distribution rather than open market dumping.”

Institutional Bitcoin Absorption

The $444 million transfer occurs against a backdrop of aggressive accumulation by U.S.-based financial institutions. BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund (FBTC) have continued to post net inflows throughout Q4 2025, requiring custodians to secure fresh inventory from long-term holders.

Data from Arkham Intelligence shows that 70% of large-scale inflows (greater than $10 million) to Binance in December have been routed to known institutional custody addresses within 24 hours of deposit.

Dormancy and Realized Cap

The reactivation of the wallet contributes to a spike in the network’s “dormancy” metric, which tracks the average age of coins moved. However, unlike the 2021 distribution phase, the current Realized Cap, the aggregate cost basis of the network, continues to climb. This divergence suggests that long-term holders are selling at a profit to buyers with a higher cost basis, effectively establishing a new price floor.

Chain Street’s Take

The headline is the $444 million, but the story is the absorption. In previous cycles, a half-billion-dollar transfer to Binance was a sell signal. In 2025, it is simply supply chain logistics.

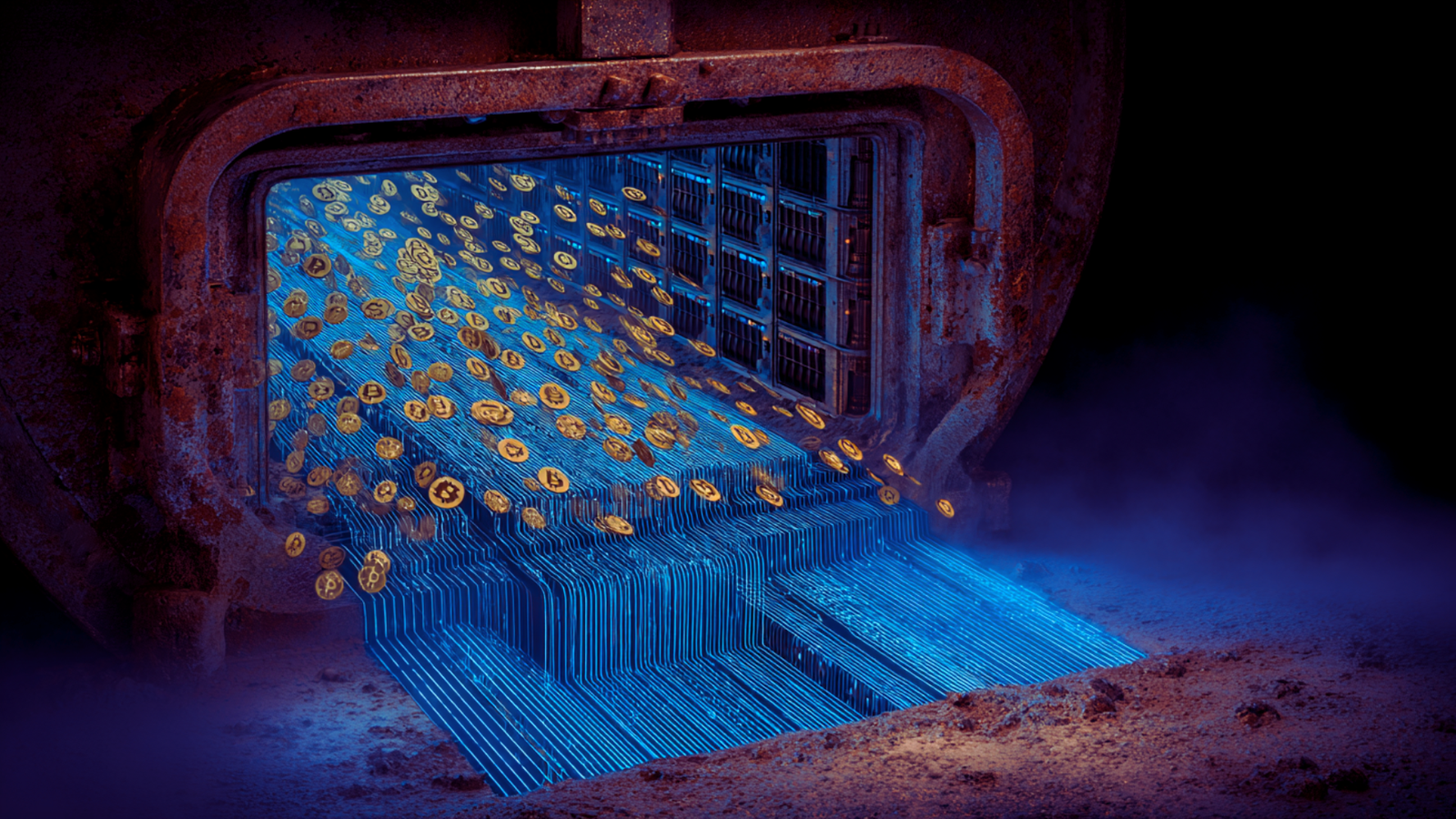

Legacy whales are finally unlocking their vaults, not to dump on retail, but to feed the insatiable maw of Wall Street issuers who have drained exchange reserves dry. This is the “Great Rotation” in real-time: Bitcoin is transitioning from a passive store of value in a cold wallet to an active macro-commodity on a corporate balance sheet.